So yesterday the CBO announces that the cost of Repealing Health Care Reform would be

$230 Billion over ten years - and to this newly minted Speaker Boehner proclaims that he's possess the powers of

Professor X.

Well, I do not believe that repealing the job-killing health care law will increase the deficit," Boehner replied. "CBO is entitled to their opinion, but they're locked within constraints of the 1974 Budget Act."

...

"I don't think anybody in this town believes that repealing Obamacare is going to increase the deficit."

Besides Beohner's

Jedi mind-reading tricks we've also had some

sweet tweets from our new Budget Committee Chairmain - Paul Ryan.

@RepPaulRyan Setting the record straight on budget-busting health care law: http://bit.ly/fndkzq

Who was

far more specific about what he feels that CBO is wrong with it's projection.

Claim: In his letter to Speaker Boehner, CBO director Elmendorf writes that the Democrats’ new health care law “would reduce budget deficits over the 2010-2019 period and in subsequent years; consequently, we expect that repealing that legislation would increase budget deficits.”

Response: The same budget gimmicks that allowed the Democrats to get a CBO score last spring saying that their massive entitlement expansion would somehow reduce the deficit are still in place today. Nothing has changed about the underlying legislation.

Claims of deficit reduction are still excluding the $115 billion needed to implement the law. The Democrats are still double-counting $521 billion from Social Security payroll taxes, CLASS Act premiums, and Medicare cuts. The score still doesn’t account for the costly “doc-fix” provision that Democrats stripped out of the bill and passed separately.

Ryan is correct to note that the change from $143 Billion in estimated savings from the original forecast only shifted to $230 Billion because this forecast is for a different period - from 2012 to 2021, instead of 2010-2019, but that both estimates work off the same basic presumptions.

Let me take the last part of Ryan's argument first because if you think about for more than a nano-second - it's truly striking in it's rank ridiculousness. Ryan is criticizing the CBO estimate for not including the cost of the "doc fix" -

Because the DOC FIX WASN'T INCLUDED IN THE LAW!

Follow me slowly here -- why exactly should the CBO include the cost of repealing something that's

Not Going to be REPEALED by the theoretical implementation of HR2?

Once you've wrapped your mind around that astounding example of illogical sollipism there's also the fact that the CBO

did address issues like this in their

original report on the final Reconciliation Bill of 2010.

Key Considerations. Those longer-term calculations reflect an assumption that the provisions of the reconciliation proposal and H.R. 3590 are enacted and remain unchanged throughout the next two decades, which is often not the case for major legislation. For example, the sustainable growth rate mechanism governing Medicare’s payments to physicians has frequently been modified (either through legislation or administrative action) to avoid reductions in those payments, and legislation to do so again is currently under consideration by the Congress

They admit that the Doc Fix was in the process of being addressed in another bill - and they logically didn't include it because,

that's a different BILL.

Ryan claims that the CBO didn't include "$115 Billion needed to implement the law" but reviewing the report I found this...

CBO expects that the cost to the Internal Revenue Service of

implementing the eligibility determination, documentation, and

verification processes for premium and cost sharing subsidies would

probably be between $5 billion and $10 billion over 10 years.

CBO expects that the costs to the Department of Health and Human

Services (especially the Centers for Medicare and Medicaid

Services) and the Office of Personnel Management of implementing

the changes in Medicare, Medicaid, and the Children’s Health

Insurance Program, as well as certain reforms to the private

insurance market, would probably be at least $5 billion to $10 billion

over 10 years. (The administrative costs of establishing and

operating the exchanges were included as direct spending in CBO’s

estimate for the legislation.)

So basically - Ryan is

Lying when he says CBO didn't include the cost of implementing the Bill. They did. He doesn't specify, but if you surmise that his "$115 Billion" comes from is the cost of implementing the State-Based High Risk Pools between now and 2014 and the Exchanges after that point (Even though CBO specifically said this was included), the problem that remains is that this

is a cost to the STATES and shouldn't be included in the

Federal Deficit!!!.

The other assumption one could make, because as I said Ryan doesn't specify where this magic money is being spent, is that's he's just plain wrong because Table 4 of the CBO report happens to

include $5 Billion for the Costs Federal Subsidies for High-Risk Pools and Exchange Subsidies.

Even when reading the speakers report on how much "

Obamacare Kills Jobs and creates a $701 Billion Deficit" it's still not clear where this "$115 Billion" comes from.

$115 billion in new government spending required to implement the health care law is not factored into CBO’s initial estimate. On May 11, CBO notified Congress that additional discretionary spending would be required to implement the government takeover of health care. This includes roughly $9 billion for both the Internal Revenue Service (IRS) and the Department of Health and Human Services

(HHS).l i

This claims simultaneously that the CBO did

not include an estimate for IRS costs - when they

actually did include these costs as between $5 and $10 Billion - and that those costs both $9 Billion and $115 Billion at the same time.

Ryan claims that CBO

Double-Counts the benefits of Medicare Savings in the plan - yet I can only find it

once - on Table 2 (Page 18) at $455 Billion in Savings over 10 Years. Yet again, this appears to be another LIE, but the Speakers report may shed some light on it.

$398 billion is claimed in Medicare Hospital Insurance Fund savings. CBO has previously noted that “to describe the full amount of HI trust fund savings as both improving the government’s ability to pay future Medicare benefits and financing new spending outside of Medicare would essentially double-count a large share of those savings and thus overstate the improvement in the government’s fiscal

position.”

Ok, I don't see a reference to $398 Billion in savings to the "Medicare Hospital Insurance Fund" (Also Known as Medicare Part-A) in the March 20, 2010 CBO Report

at all - so that looks like

yet another lie. The report notes a Medicare Fee-for-Service Rate (which includes Parts-A and B) reduction of $193 Billion and a Medicare Advantage (Part C) reduction of $139 Billion. So basically the Republcans are saying CBO claimed $398 Billion in savings for Part-A

ALONE but CBO actually say Part A, B, & C savings all together only comes up $332 Billion which still doesn't add up to $398 Billion.

And on top of all that Medicare Trustee Report

Says This...

The Medicare Hospital Insurance (HI) Trust Fund is projected to remain solvent until 2029, 12 years longer than reported in 2009 thanks to the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, according to the Medicare Board of Trustees 2010 annual report, which was released today. In addition, the HI long-range actuarial deficit has been reduced to 0.66 percent of taxable payroll, or one-sixth of its projected amount before enactment of the Affordable Care Act. Although HI costs are estimated to continue to exceed trust fund income for the next few years, as they have since 2008, the savings under the new health reform act are expected to result in fund surpluses during 2014-22.

So according to the Trustees Report, the same report that in 1994 sent the Gingrich Congress into a desperate flat-spin tizzy to force a Balanced the Budget by 2002 and consequently

Shutdown the Government - TWICE, Medicare - as of now - is headed for a

Surplus in 2014 as shown by this chart.

Table II.E1.—Estimated Operations of the HI Trust Fund

under Intermediate Assumptions, Calendar Years 2009-2019

[Dollar amounts in billions] |

| Calendar year | Total income | Total expenditures |

Change in

fund | Fund at year end |

Ratio of assets to

expenditures |

| 2009 | 225.4 | 242.5 | -17.1 | 304.2 | 132 |

| 2010 | 217.6 | 249.3 | -31.7 | 272.5 | 122 |

| 2011 | 241.5 | 259.3 | -17.8 | 254.7 | 105 |

| 2012 | 254.4 | 271.2 | -16.8 | 237.9 | 94 |

| 2013 | 277.0 | 282.5 | -5.5 | 232.4 | 84 |

| 2014 | 297.2 | 296.0 | 1.2 | 233.6 | 79 |

| 2015 | 315.9 | 305.0 | 10.8 | 244.4 | 77 |

| 2016 | 336.6 | 321.2 | 15.4 | 259.8 | 76 |

| 2017 | 357.2 | 338.2 | 19.0 | 278.8 | 77 |

| 2018 | 377.9 | 357.9 | 20.0 | 298.8 | 78 |

| 2019 | 397.9 | 379.7 | 18.2 | 317.0 | 79 |

More from the Trustees

The Affordable Care Act has introduced important changes to the

Medicare program that are designed to reduce costs, increase

revenues, expand the scope of benefits, and encourage the

development of new systems of health care delivery that will improve

health outcomes and cost efficiency.

Also, getting back to Ryan again, as a result of the Tax Deal that Obama made with Congressional Republicans last month, Social Security Payroll taxes were REDUCED by 2% so it's no longer a benefit to the deficit, it's now a negative.

Now while Ryan has a field day trying to rip the CBO a brand new orifice with his latest batch of tweets he seemed

proud as punch to accept it's conclusions when it review HIS socalled "

Roadmap for America".

The Roadmap is my attempt to offer America a choice, an alternative to Progressivism’s dreary path to welfare statism. It shows, using CBO analysis, that it is not too late for America to choose a path true to its founding ideas. We can still be that exceptional nation.

So when the CBO says something that Republicans like Beohner and Ryan

dogmatically choose not to believe they say the Congress Official Non-Partisan Budget Umpire is "Entitled to their Opinion", but when they want to bolster the clout of their own ideas they

TOUT the fact that it's been analyzed by the CBO?

Hypocrit Much, Mr Ryan?

Of course, while he crows about his plan being CBO scored he ignores what the CBO

actually said about his plan.

On Social Security Ryan's plan would both cut benefits and RAISE payroll taxes.

Traditional retirement benefits would be reduced below those scheduled under current law for many workers who are age 55 or younger in 2011.

The Roadmap would also eliminate the income and payroll tax exclusions for

employment-based health insurance. As a result, more earnings would become taxable for Social Security purposes, thus boosting future benefit payments, and payroll tax revenues credited to the Social Security trust funds would increase.

On Medicare the eligibility age would be raised, and the system converted into vouches program which would slash it's effectiveness.

The age of eligibility for Medicare would increase incrementally from 65 (for people born before 1956), as it is under current law, to 69 years and 6 months for people born in 2022 and later. Starting in 2021, new enrollees would no longer receive coverage through the current program but, instead, would be given a voucher with which to purchase private health insurance.

Welcome to the wonderful world of

Health Stamps.

And on the Budget?

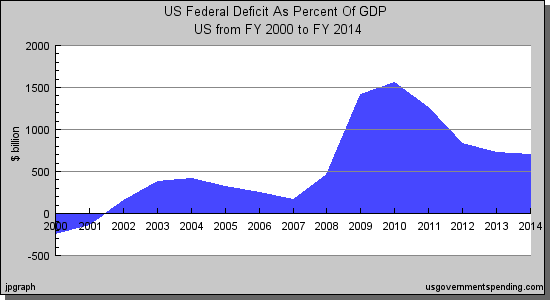

The Roadmap, in the form that CBO analyzed, would result in less federal spending for Medicare and Medicaid as well as lower tax revenues than projected under CBO’s alternative fiscal scenario (see Table 1). On balance, those changes would reduce federal budget deficits and the federal debt.

So it would cut the deficit, which as a point in fact is

already going down, but it would do so by punishing the poor, the sick and the old at a time when

74% of the Public supports raises taxes on the Rich to Balance the Budget.

So much for the "Will of the People"

Contrast that result with both the CBO and the Medicare Trustees say that the "Obamacare" reduce the deficit, increase the number of people covered and improve quality.

Bu there is another source that both Boehner and Ryan have depended on, a report from he Independant Centers for Medicare and Medicaid which the Heritage Foundation

Characterized this way.

Obamacare will bend the cost curve up, causeing an additional $289 billion in expenditure

Millions will lose their existing private coverage

18 million Americans will either face jail time or be forced to pay a new tax they will receive no benefit from.

8.5 million seniours who currently get such services as coordinated care for chronic conditions, routine eye and hearing examinations, and preventive-care services would lose their existing private coverage.

More than half the people who gain health insurance will receive it through the welfare program Medicaid.

Hospitals currently serving Medicare patients might be forced to stop doing so, thus making it much more difficult for seniors to get health care.

Supply constraints will mean that the 21 million people who are gaining health insurance through Medicaid are going to have a very tough time finding a doctor who will treat them.

Yet, Surprise surprise - the actual

CMS Report says nothing of the kind.

By 2019, the mandates, along with the Medicaid expansion would reduce the number of uninsured from an estimated 57 Million - to 23 Million.

Another 10 Million people would gain insurance through the newly created Exchange. Finally, we estimate the number of persons with employer-based insurance would increase by 2.9 Million.

CMS estimated that the total Cost of the Bill (which actually was the House Version of the Bill which was voted out in November of 2009 and Included The PUBLIC OPTION, not the final Bill that passed both the house and Senate) was $406 Billion over 10 years, including $900 Billion in outlays and over $571 Billion in Medicare Savings. They also estimated that the Costs for Plans Offered through the Public Option would be 5% lower than private plans, but that their premiums would be 4%

Higher because of the "anti-selection by enrollees" - so that gives you an insight as to how their thinking seems to work.

There are a lot of differences between the CBO and CMS report but the most obvious thing that jumps out to me is their differing assumptions on the amount of subsidies and affordability credits available via the Exchange. CBO estimates that these credits will cost $107 Billion over the course of 10 years, where the CMS assumes it would cost $591 Billion. (As Jamie Henneman might say - "

There's your problem") Exactly who is more correct is debatable since it all depends on how many people choose to join the exchange and how many of them will need subsidies. It's fair to say either of their estimate could be correct, and they both could be wrong - but we won't really know until 2019.

It's fair to note that the CBO also includes excise taxes on high-premium plans ($32 Billion), reinsurance and risk assessment collections ($106 Billion) that the CMS report doesn't include because it's focus is only on the outlays and savings associated primarily with Medicare and Medicaid

not Taxes that will be collected and the fact that it's based on an earlier House version of the Bill,

not the final version that passed and was signed by the President.

However you parse the disagreement here between CBO and CMS (or the Medicare Trustee's Report) it's clear that

NONE OF THEM support half the claims we see coming from Republicans and the Heritage Foundation over Health Care. None. Zero. Zilch.

Vyan